Construction Outlook: October 2025

The outlook for GB construction is one of modest decline over the years 2025-2026. Following growth of 0.5% in 2024, we expect total construction output to drop by 1.4% in 2025 and 1.8% in 2026.

The profile of output growth since 2021 has been one of a gradual weakening, with the post Covid rebound (seen over 2021-2022) followed by modest growth in total work. However, this growth disguises a downturn in new work from 2023, with new work output falling by 2% in 2023 and 5% in 2024. We expect further, albeit more modest, falls over the years 2025-2026.

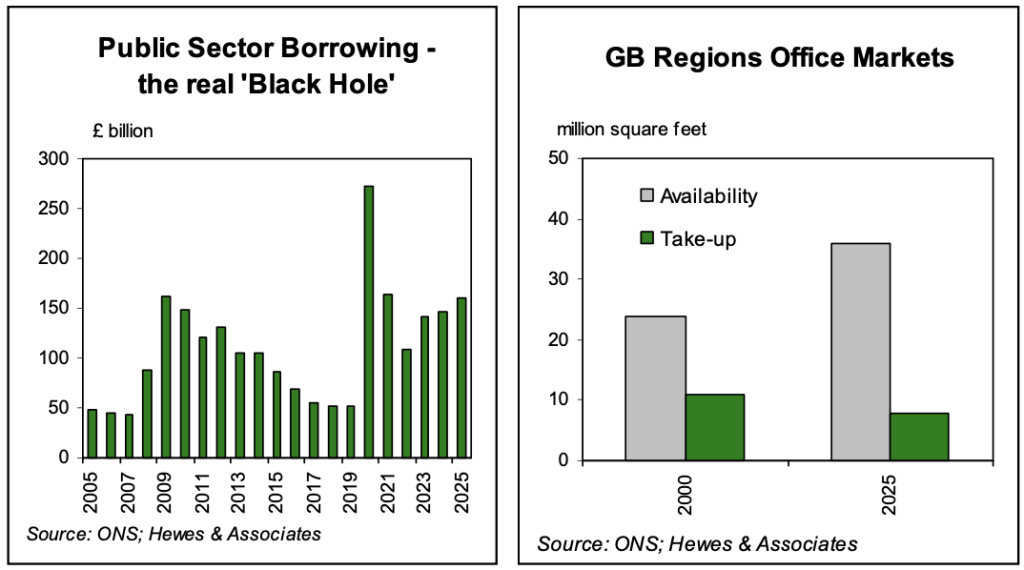

Underlying the above weakness in new work is a falling orders pipeline. The volume of new work orders is presently 20% below the late 2022 high, and a good deal of this decline relates to private housing and commercial work. In the commercial sector orders are close to 25% below the early 2022 high, while private housing orders are around 40% below the early 2022 high, with the rate of decline worsening over the first half of 2025. Given the weak economic outlook – we expect marginal to zero GDP growth over the next few years – the outlook for both private housing and commercial building is poor. On that note, the Government’s 1.5 million homes plan is now over a year old and yet to take shape – we do not expect much improvement concerning this.

Industrial building order volumes fell by 17% over the twelve months to June 2025, and are now 42% below the 2022 high. Extreme weakness in the warehouse market, alongside troubles in the factory market explain matters, and with high energy costs and a weak economy the outlook is one of falling output.

The government funded sectors offer some hope, with the inflow of work in public non-housing and infrastructure increasing over 2024/early 2025.