Construction Outlook: July 2025

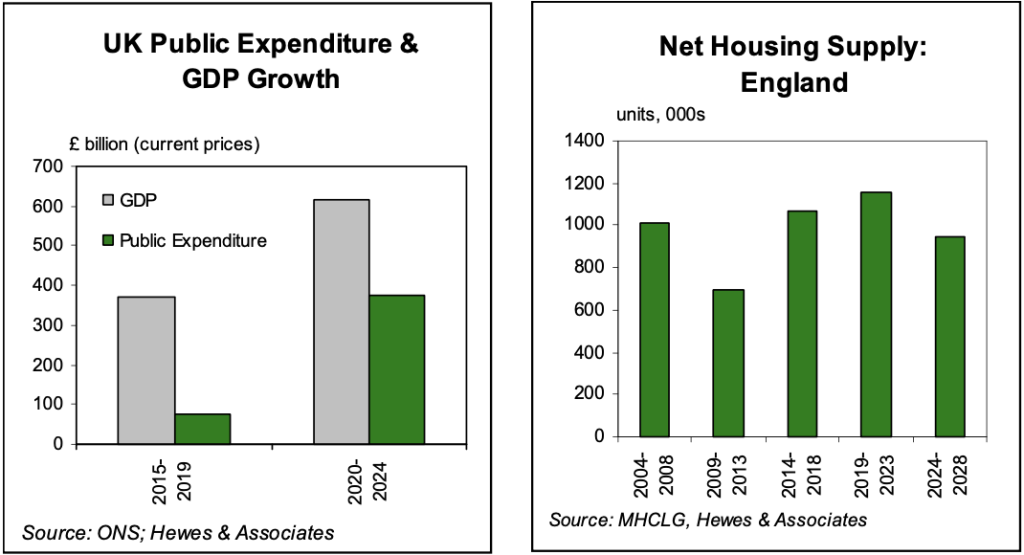

The outlook for GB construction remains dull, largely due to ongoing weakness in the housing market. Meanwhile, the economy continues to perform badly, and it is our view that the trend of weak GDP growth, accompanied by near zero GDP per capita growth, will remain with us this decade. GDP per capita – the key measure of living standards – is no higher than in 2019, and only 6% above that in 2007/2008. Certainly, at the moment there does not seem to be any policy measure on the horizon set to end this situation. Meanwhile, the public sector is commanding a larger share of economic activity, and set to do so over the next few years: in the process this is presenting the nation with extreme public sector fiscal difficulties.

After rising marginally in 2024, we expect the volume of construction output to fall by over 1% in both 2025 and 2026. Much of this decline relates to the new build sector, which fell by 5% in 2024. We expect new work volumes to decline in both 2025 and 2026, with weakness in the private housing and commercial sectors key features.

The Government’s 1.5 million homes plan is now a year old and yet to take shape. A key problem with the plan is its failure to take account of demand. Land supply and planning are important issues, but development is a function of demand as well as supply, and if builders cannot sell as much as they would like, they will adjust building volumes down. This thinking underlies our housing forecasts to 2029, which outlines roughly 1 million houses built over the five years 2025-2029. This forecast assumes base rates of around 4% to 2029.

The government outlined grand investment plans in its Spending Review, although much depends upon supplementary private sector funding. For instance, the latest ten-year public sector housing plan relies upon private sector funding, as does Sizewell C, and the Lower Thames Crossing. This implies investment delays.